41+ which fico score do mortgage lenders use

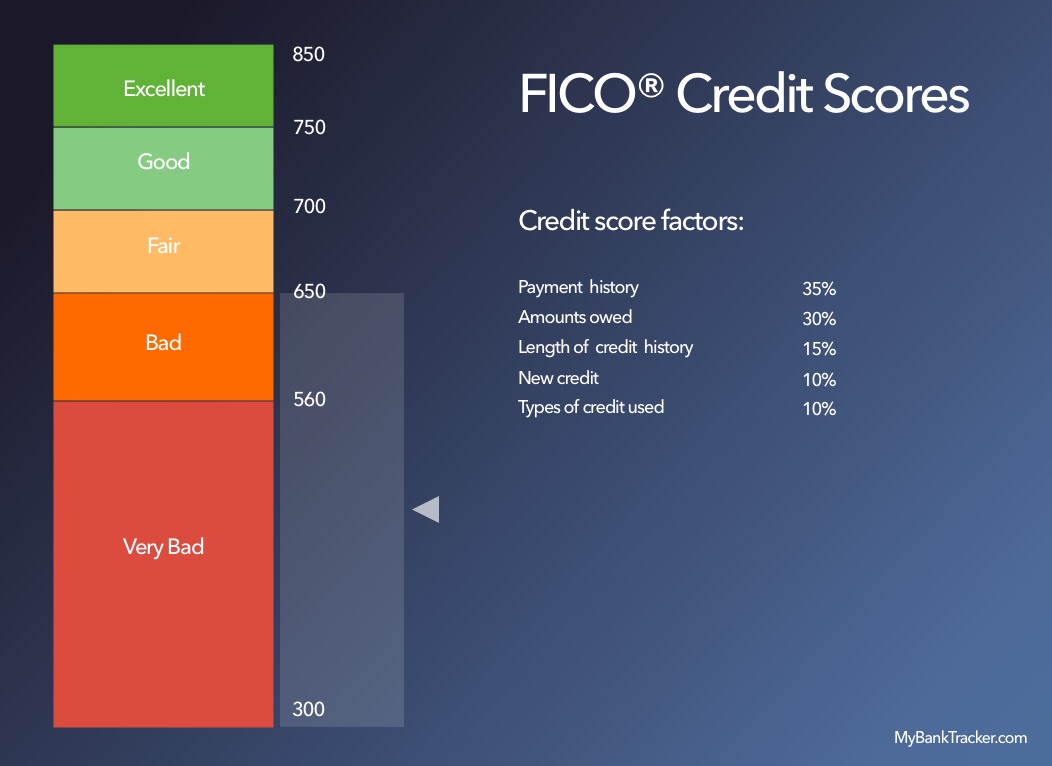

Web The overall FICO score range is between 300 and 850. Mortgage lenders may also use FICO Score 2 or FICO Score 4 in their decisions as well.

Brian Leneweaver Coldwell Banker Realty

According to FICO the majority of lenders pull credit histories from all three credit reporting agencies as they evaluate mortgage applications.

. If your three FICO scores were 700 709 and 730 the lender would use the 709 as the basis for its decision. Web Your FICO scores an acronym for Fair Isaac Corp the company behind the FICO score are credit scores. And the higher the better.

Both FICO and VantageScore calculate credit scores in a range between 300 to 850 and both put the most weight on payment history and credit utilization the amount of credit a cardholder is. Web And in a process that only exists in mortgage lending the lender bases its decision not on your highest credit score not on your lowest score but rather on the middle numeric score. Web Most mortgage lenders only consider FICO scores but some also will look at a VantageScore typically gleaned from one of the two latest scoring models.

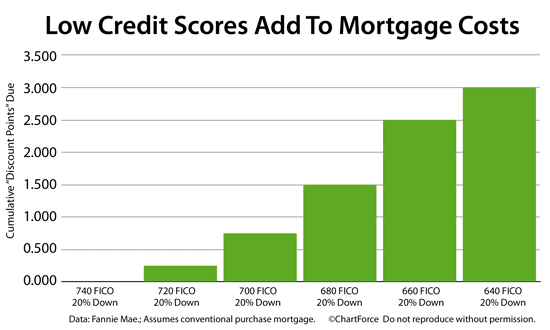

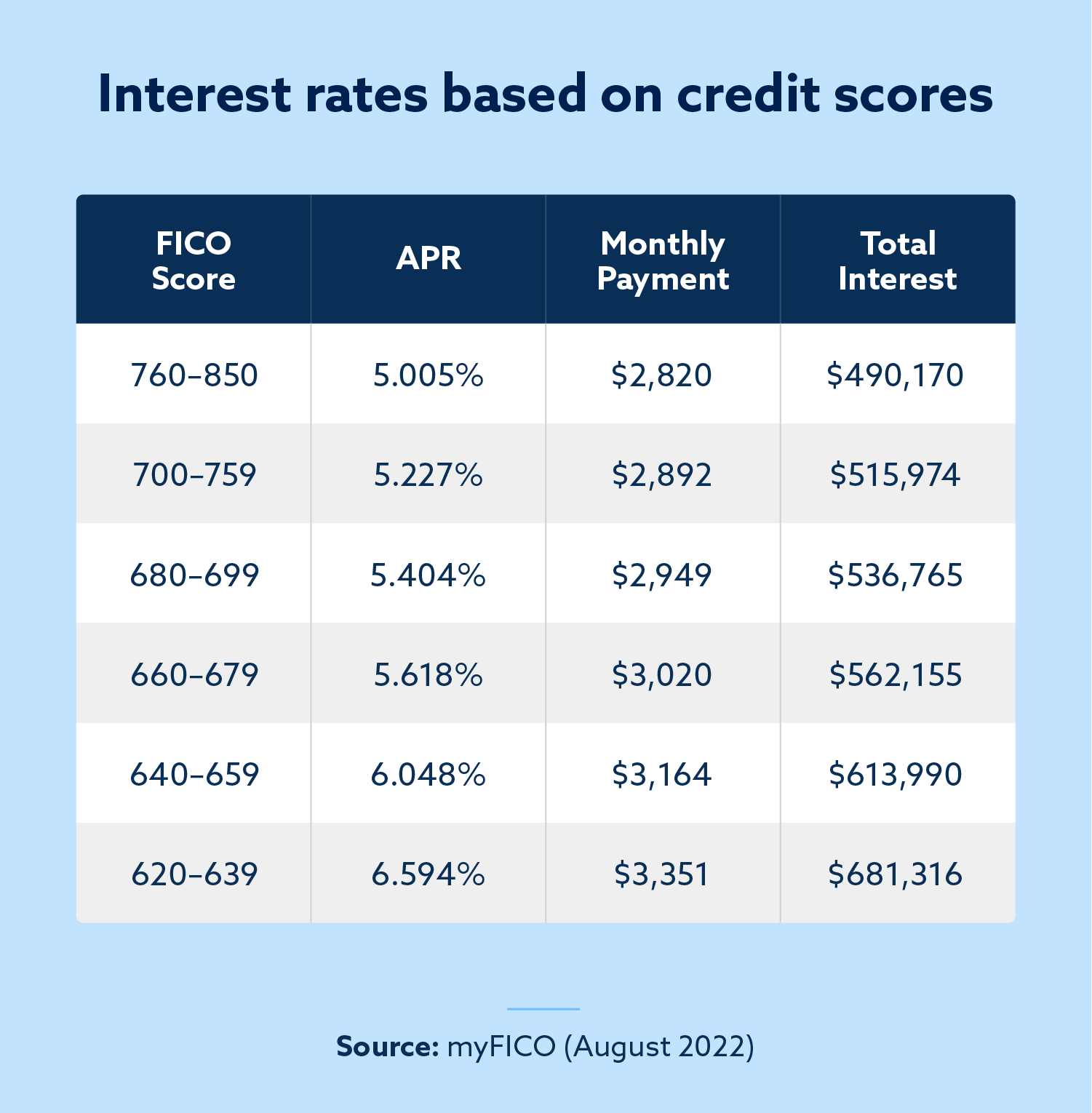

The higher your credit score the better interest rate youre likely to get which also means youll have a lower monthly mortgage payment. Web The scoring model used in mortgage applications While the FICO 8 model is the most widely used scoring model for general lending decisions banks use the following FICO scores when you. Web The FICO score range helps mortgage lenders determine what type of borrower you are based on the financial picture provided by your personal score.

Each score is based on information the credit bureau keeps on file about you. The vast majority of mortgage lenders use the same ones. FICO Score 2 4 and 5.

Web The FICO scores used for mortgages. Web There are five different FICO score models currently used by most lenders of all types. The lower the FICO score the greater the risk of.

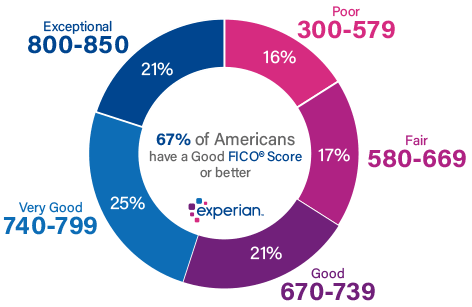

Web Which Lenders Use Which FICO Scores. Web Lenders use credit scores to determine a borrowers level of risk. In contrast borrowers in the 580 to 669 range may find it difficult to obtain financing at attractive rates.

Its a sort of grade based on the information contained in your credit reports. Web The most commonly used FICO Score in the mortgage-lending industry is the FICO Score 5. How to get started.

Web FICO scores are the credit scores most lenders use to determine your credit risk and the interest rate you will be charged. Web The FICO Score versions used in mortgage lending and the more recently released versions such as FICO Score 9 and 10 have the same 300 to 850 range. Web Most lenders look at a borrowers FICO score formerly Fair Isaac Corporation but there are even multiple FICO scores for each borrower.

In general scores in the range of 670 to 739 indicate a good credit history and most lenders will consider this score to be favorable. TransUnion FICO Risk Score Classic 04. 2 TransunionFICO Classic 04.

FICO Score 4 or TransUnion. ExperianFair Isaac Risk Model V2SM. Unlike the grades you were given in school A through F base FICO scores generally range from 300 to 850.

Web Lenders have identified a strong correlation between Mortgage performance and FICO Bureau scores FICO score. Web Most mortgage lenders use the FICO Credit Scores 2 4 or 5 when assessing applicants. FICO scores range from 300 to 850.

These are sometimes listed on the tri-merge mortgage report as follows. FICO Score 5 TransUnion. VantageScore a competing maker of credit scores also uses that range for its latest VantageScore 30 and 40 model credit scores.

With the exception of the mortgage market which is heavily regulated lenders can generally choose which FICO score they use when running a. Web 2 days agoNational averages of the lowest rates offered by more than 200 of the countrys top lenders with a loan-to-value ratio LTV of 80 an applicant with a FICO credit score of 700760 and no. Web The three scores they will look at specifically are the FICO Score 2 sometimes called the ExperianFair Isaac Risk Model v2 the FICO Score 5 known as the Equifax Beacon 5 and the FICO Score 4 or TransUnions FICO Risk Score 04.

Mortgage lenders who offer conventional mortgages are required to use a FICO Score when they underwrite your loan application for approval. The specific scores used by each bureau are as follows. Web The FICO scores that mortgage lenders commonly use according to Experian are.

FICO Score 5 or Equifax Beacon 5. EquifaxFICO classic V5 FACTA. Web The most widely used version is FICO Score 8 but the most frequently used versions in mortgage lending are.

Theyre called FICO mortgage scores. FICO Score 2 or ExperianFair Isaac Risk Model v2. You have three FICO scores one for each of the three credit bureaus Experian TransUnion and Equifax.

FICO Score 4 Industry-specific scores are fine-tuned based on the specific risks of each industry. FICO Score 2 Equifax. Three credit bureaus Equifax Experian and TransUnion calculate an individuals credit score.

These are the models used by the credit bureaus Experian TransUnion and Equifax respectively. FICO Score 2 or ExperianFair Isaac Risk Model v2. For example an excellent score is considered 800-850 while a poor score is 300-579.

1 FICO Score 8 is the most common especially with credit card companies but FICO Score 5 can be popular among car lenders and mortgage providers.

Fico Score The Score That Lenders Use

How Checking Account Impacts Your Credit Score Mybanktracker

The Average Credit Score To Qualify For A Mortgage Is Now Very High

The Average Credit Score For Approved Mortgages Is Declining

What Are The Different Fico Scores Used In Lending Decisions

Credit Score And Getting A Home Loan Seth Stefanko

Fico Score The Score That Lenders Use

G400311mmi003 Gif

Credit Score Under 740 Prepare To Overpay On Your Mortgage

41 61ac Highway 69 Point Tx 75472 Realtor Com

Do All Mortgage Lenders Credit Score Mortgage Plus Lenders That Don T

Free 41 Application Forms In Ms Word

Royal Loan Services Go From Financial Stress To Financial Yes

What Credit Score Do You Need To Buy A House Palmetto Mortgage Of Sc Llc

Which Credit Scores Do Mortgage Lenders Use Experian

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/xlmedia/COCQHHMW7BFQNLMMWB46XDT6ZM.jpg)

Which Fico Scores Do Mortgage Lenders Use The Dough Roller

What Credit Score Do Mortgage Lenders Use Lexington Law