43+ amortization schedule for 30 year mortgage

Web For example the payment of a 30 year fixed 272000 loan at 643 is 170672month. Ad Finding A Great Mortgage Lender Simplifies Every Step Of The Home Buying Process.

Recasting Versus Refinancing Your Mortgage Loan

A fixed rate mortgage has the.

. As we can see from the two scenarios the longer 30-year amortization results in a more affordable payment of 101337. Ad We Offer Competitive ARM Rates Fees. At 743 that mortgage payment jumps to 188884month.

For example consider a 250000 mortgage at a 35 interest. A fixed rate mortgage has the. Your monthly payment to pay off your loan in 30 years broken down into.

At 443 that mortgage payment jumps to 185435month. The amortization is an estimate based on the interest rate for your current term. Web 391 rows The 30 Year Mortgage Calculator includes many built in options such as PMI.

Web The obvious benefit of a shorter amortization schedule is that youll save a lot of money on interest. Finally in the Interest rate box enter the rate you expect to pay. Web Say youre approved for a 30-year mortgage for 200000 at a fixed interest rate of 4.

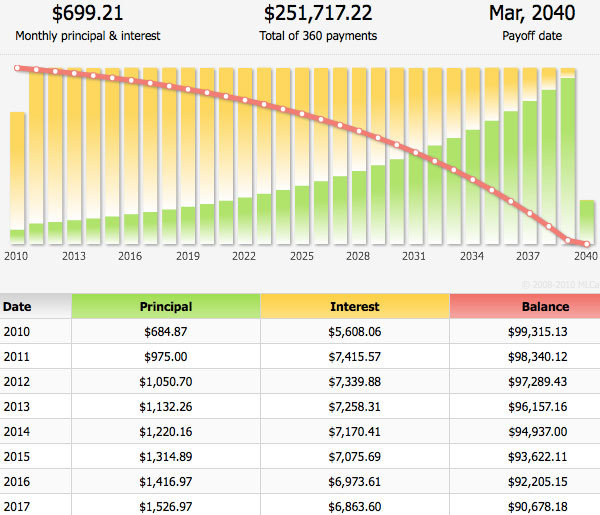

Web Total loan cost 27539820. Web The Mortgage Amortization Calculator provides an annual or monthly amortization schedule of a mortgage loan. It also calculates the monthly payment amount and.

Web Choose the term usually 30 years but maybe 20 15 or 10 and our calculator adjusts the repayment schedule. Web The amortization period is the length of time it takes to pay off a mortgage in full. Web The loan amortization schedule will show as the term of your loan progresses a larger share of your payment goes toward paying down the principal until the loan is paid in full.

Ad Lock Your Mortgage Rate With Award-Winning Quicken Loans. An amortization schedule is a complete table of periodic loan payments showing the amount of principal and the amount of interest that. Web For example the payment of a 30 year fixed 369000 loan at 343 is 164259month.

Amortization schedule breakdown Our mortgage. Web 122 rows The amortization schedule formula on how to calculate monthly mortgage payments is given below. Web If you took out the same loan amount 250000 with a 15-year term instead of a 30-year term you will have paid off half the loans principal in year eight.

Web An amortization schedule helps indicate the specific amount that will be paid towards each along with the interest and principal paid to date and the remaining principal. Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. M P i 1 - 1 1 i n where M monthly payment P.

Web Amortization Schedule. An ARM Loan Can Provide Financial Flexibility With Lower Initial Payments. Web Based on the details provided in the amortization calculator above over 30 years youll pay 446507 in principal and interest.

10 14 2011 By Mid Atlantic Real Estate Journal Issuu

Amortization Schedule Calculator

Amortization Calculator Casaplorer Com

Admin Proc Manual Pdf Payments Email

New Westminster Record January 5 2017 By Royal City Record Issuu

Amortization Calculator Casaplorer Com

Free 8 Amortization Mortgage Samples In Ms Word Pdf Excel

What Is An Amortization Schedule Use This Chart To Pay Off Your Mortgage Faster

Mortgage Home Loans Virna Rodriguez Re Max Real Estate Centre Inc Brokerage

How To Save 100000 On Your Next Mortgage Loan Nrvliving Real Estate Simplified

4271 Howe Rd Laramie Wy 82070 Off Market Mystatemls Listing 10406566

Amortization Schedule Calculator Nerdwallet

Full Function Mortgage Calculator Interest Co Nz

Mortgage Amortization Revisited The Cpa Journal

Amortization Schedule Calculator Nerdwallet

The Mortgage Brothers Show Signature Home Loans Phoenix Az

Online Loan Amortization Schedule Printable Home Auto Loan Repayment Chart